Is Your Business Prepared for the Plastic Tax?

Date: 14/06/2021 | Environmental, Regulatory Law

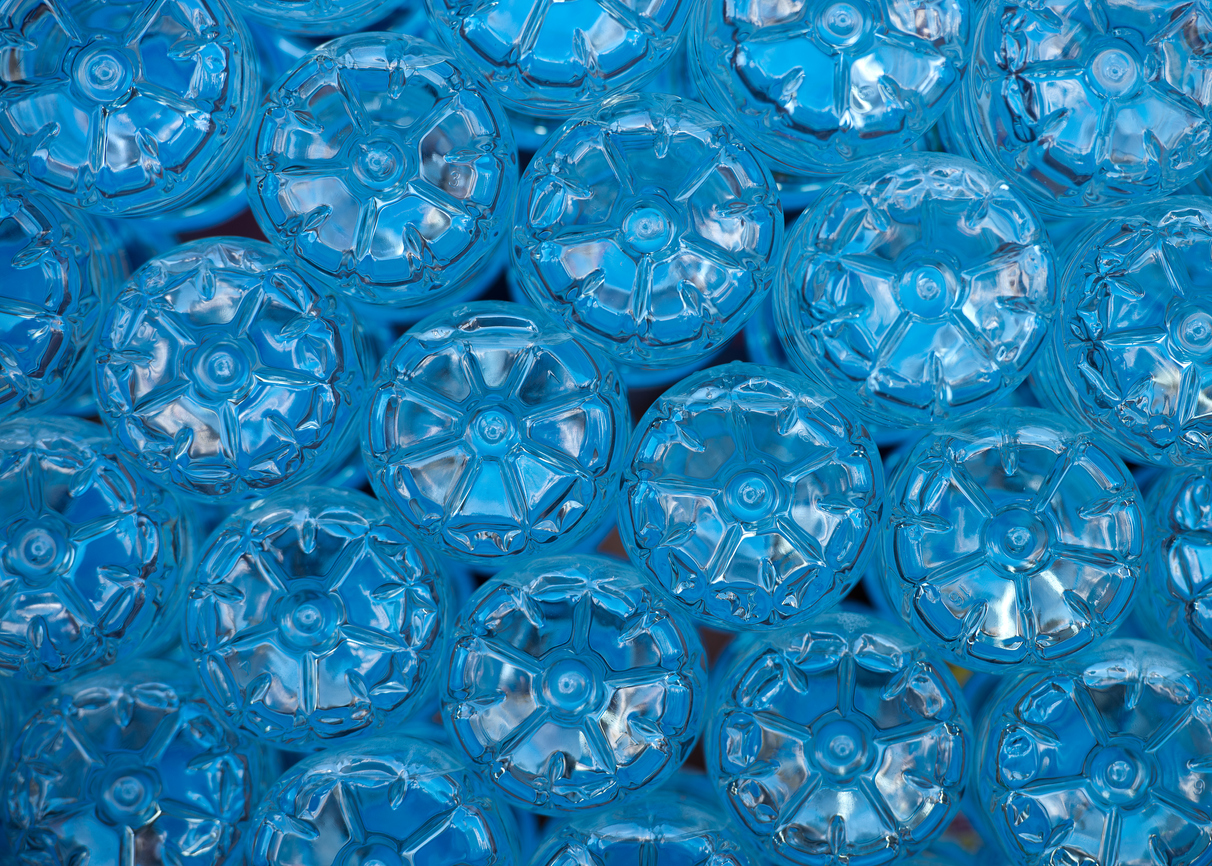

The UK Government is introducing a plastic packaging tax set to take effect from April 2022. The aim is to provide an economic incentive for business to use recycled material in the production of plastic packaging, which will create greater demand for this material and in turn stimulate increased levels of recycling and collection of plastic waste, diverting it away from landfill or incineration.

Who will the tax affect?

UK producers of plastic packaging and importers of plastic packaging will be affected directly, as they are liable for paying the tax. However, the cost is likely to be passed on to business customers of producers and importers of plastic packaging and consumers who buy goods in plastic packaging in the UK.

Businesses producing or importing plastic packaging which does not contain at least 30% recycled plastic and businesses or consumers purchasing such goods will soon find their profit margins squeezed.

Key features of the plastic tax:

- The tax applies to plastic packaging produced in or imported into the UK which does not contain at least 30% recycled plastic.

- The plastic packaging will be presumed to contain less than 30% recycled plastic unless the producer or importer can show that it does.

- The tax will be charged at £200 per metric tonne on plastic packaging with less than 30% recycled plastic content.

- Plastic packaging is defined as packaging which is predominantly plastic by weight.

- Imported plastic packaging will be liable to the tax, whether the packaging is unfilled or filled.

- The draft legislation defines ‘Recycled plastic’ as plastic that has been reprocessed from recovered material by means of a chemical or manufacturing process so that it can be used either for its original purpose or other purposes.

- Small operators who manufacture or import less than 10 tonnes of plastic packaging in a 12-month period are exempt from the charge.

- The tax will not be chargeable on plastic packaging which:

- Is manufactured or imported for use as immediate packaging of licenced human medicines;

- Is in use as transport packaging to import products into the UK; or

- Is exported, filled or unfilled, unless it is in use as transport packaging to export products out of the UK.

Challenges:

Any attempt to increase recycling rates and divert waste from landfill and incineration are to be welcomed and should significantly benefit Scotland’s environment. However, this new tax poses some major challenges for businesses at a time when many will be just getting back on their feet following the upheaval resulting from Covid-19 and Brexit.

With just under a year to go before its roll-out, a major concern is whether the UK will have the requisite infrastructure in place for collection and recycling of the plastic material required so that there is sufficiency of supply for businesses who wish to use it and avoid the tax. The government’s position appears to be that availability of suitable material will follow the introduction of the tax, but timing is critical. Regulatory constraints which apply to what recycled material can be used for, for example in food packaging, also create some difficulty.

It is important that the plastic packaging tax does not simply become an unavoidable additional cost to already struggling businesses due to their inability to source the required recycled material.

At Davidson Chalmers Stewart we assist organisations in understanding what their responsibilities are, and will be, and help them to plan for the changes which need to be made to ensure business continuity. If any of these issues resonate with you or you would like to understand more about the potential impact on your business, please contact Laura Tainsh at laura.tainsh@dcslegal.com for more information or advice.