Choosing the Right Charity Structure

Date: 11/02/2025 | Corporate

If you are thinking about setting up a charity in Scotland, one of the first things you need to consider is what form your charity will take. This is because you will need to tell the Scottish Charity Regulator (OSCR) what type of organisation your charity will be when you apply to register as a charity. But how do you decide which legal form is right for your charity?

Incorporated or Unincorporated?

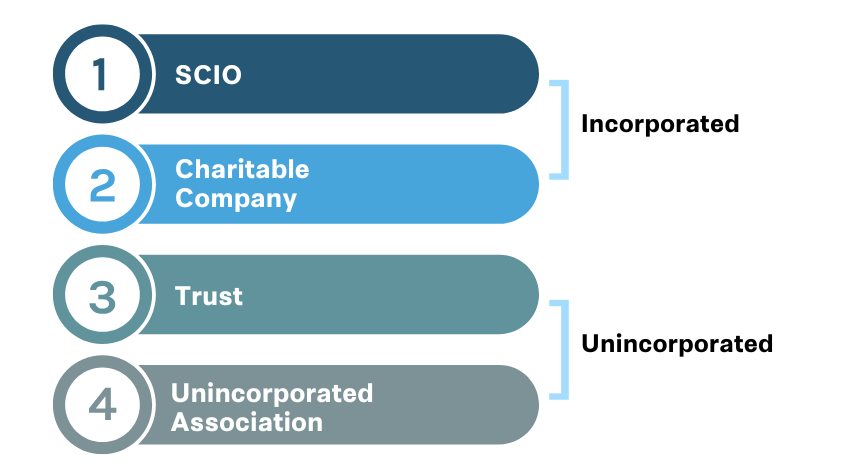

When choosing your charity’s legal form, the first question to ask will be whether you want your charity to be incorporated or unincorporated – and the answer will depend on what your charity is going to do.

Being incorporated means that your charity is a legal entity in its own right, separate from the people who run it. That means the charity can do things in its own name (such as hiring staff and entering into leases and other contracts and purchasing property), and it usually means that the trustees won’t be personally liable for the actions or debts of the charity.

Being unincorporated usually means that the trustees will enter into contracts on behalf of the charity, in their own names. That means that if things go wrong, the trustees could be held personally liable for the actions or debts of the charity.

If your charity intends to enter into any valuable or significant contracts, including hiring staff, it’s most likely that an incorporated form will be suitable for you.

Four Most Common Types of Charity

Below, we set out the key points relating to each entity.

Scottish Charitable Incorporated Organisation (SCIO)

- The vast majority of new charities in Scotland are set up as SCIOs.

- Incorporated entity.

- Only registered with the Office of the Scottish Charity Regulator (OSCR) (so only concerned with one set of annual filings).

- Can enter into contracts and hold title to land and buildings in its own name.

- Application process – apply to OSCR, giving all of the usual details (see here for more information).

- Needs a SCIO-specific constitution setting out the charity’s charitable purposes, the activities it will do, and how it will be governed.

- Certain SCIO-specific rules – e.g. the members of the charity (as well as the trustees) will have certain legal duties.

- If a SCIO loses its charitable status, it is automatically dissolved.

Charitable Company

- Used to be the preferred incorporated form of charity (before SCIOs existed).

- Registered with Companies House and OSCR – so subject to company law and charity law.

- Can enter into contracts and hold title to land and buildings in its own name.

- Application process – register company with Companies House, and apply to OSCR for charitable status.

- Needs Articles of Association (its constitution) which is approved by OSCR.

- Charity trustees will wear two “hats” –charity trustees for the purposes of charity law, and directors for the purposes of company law.

- If it loses charitable status, a company can continue to exist.

Trust

- Unincorporated entity, best suited to groups who want to manage money or property.

- Charity assets including land are owned by trustees and managed on behalf of specified beneficiaries.

- Trustees will undertake transactions on behalf of the charity – so risk of personal liability for the charity’s debts.

- Set up by trust deed, which must be approved by OSCR. Apply to OSCR for charitable status.

- Only registered with OSCR.

- Subject to trust law and charity law.

Unincorporated Association

- Unincorporated entity, more suitable for smaller charities with fewer contractual obligations.

- Informal and easy to set up.

- Only registered with OSCR.

- Trustees must hold title to land and buildings in their own names on behalf of the charity.

- Trustees will undertake transactions on behalf of the charity – so risk of personal liability for the charity’s debts.

- Application process – apply to OSCR in the usual way.

- Trustees can make their own rules, and a copy of the constitution must be approved by OSCR.

Can a Scottish charity change legal form later?

Some charities can change legal form, for example if its circumstances change. However, in many cases the charity will be required to transfer its assets to a new charity, with the old charity then being wound up. The process, if done properly, will likely incur legal and accounting costs, and there may be tax consequences. In addition, you might need to get permission from organisations you work with such as public bodies, banks, as well as OSCR. That being the case, wherever possible it would be prudent to choose a legal form that will suit your charity in the long term.

Where can I get help?

At Davidson Chalmers Stewart we are adept in advising charities on all of these issues. For more advice, please contact Lisa Kitson at lisa.kitson@dcslegal.com (0131 290 2812).

Disclaimer

The matter in this publication is based on our current understanding of the law. The information provides only an overview of the law in force at the date hereof and has been produced for general information purposes only. Professional advice should always be sought before taking any action in reliance of the information. Accordingly, Davidson Chalmers Stewart LLP does not take any responsibility for losses incurred by any person through acting or failing to act on the basis of anything contained in this publication.